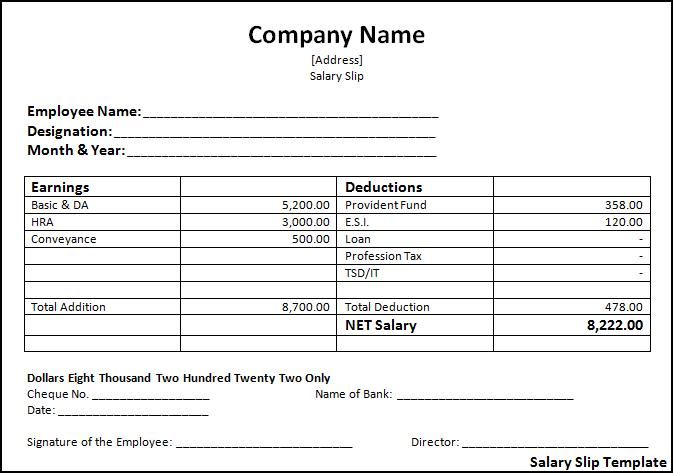

Amount paid for that period and Year to Date (starting from 1st Jan until that Pay stub Date).Employer/Employer Information, Pay Date, Pay Period etc.California Pay Stub Sample: New York Pay Stub Sample: Information present in Pay Stub: Even though the employee’s GROSS pay is more, NET PAY is less because of taxes, and benefits. We have given samples of pay stub of California and New York. Employees working with two different employers NET PAY will be also different for the same GROSS PAY in same state/county/city /exemptions because of the benefits offered by the employer. You should also check Template Of Sales Invoice.The NET PAY on pay stubs (also known as pay slip or salary slip) for the same GROSS PAY for an employee working with the same employer will be different based on cities, counties, states and exemptions/deductions where the employee works because in some states there is no state tax/high state tax/less state tax. Additionally, if you want to take a loan from the bank then to prove your ability to repay back, the bank can demand a payslip. To increase the employee morale and motivation, it provides an efficient record of the employee. The slips also contain information for how many days employees took leaves and what type of leaves they took. It also helps to calculate the days of the employee in a month. Thus, by using Excel salary slips, it becomes easy for them to manage the payslips of each employee. Furthermore, the employer has no time to manage and manually calculate salaries of the each employee. For future legal considerations, this slip can be used against an employer. The organization used it to determine the designation of an employee. The salary slip format in excel enables assists the organization to manage the financial record of each employee. Importance of salary slip format in MS Excel: To pay tax to the government, the employer deducts a certain income tax from the employee’s salary. Both employer and employee equally contribute to this scheme. Moreover, it prevents the employees’ interest in certain situations like unemployment, illness, marriage, etc. Professional tax:Īn employer can deduct the professional tax from the salary. Some different types of allowances are house rent allowance, conveyance allowance, dearness allowance, medical allowance, etc. Allowances:Īllowances are the amount that the company gives for free to the employee. After deductions and commission additions, write down the payment received by the particular employee. It is the minimum payment that an employee receives each month. Write down the name of the employee, his department name, and bank account number. The important elements that should be included in every salary slip are Employee’s information Important elements of salary slip format in Excel:

0 kommentar(er)

0 kommentar(er)